How can an RICS member help?

When you buy, live in or sell a home, take advantage of professional expertise and independent advice by using estate agents and surveyors who are RICS members.

Your home is likely to be one of the most expensive purchases you ever make – you need to know as much as you can about the property before you buy it, live in it, and when you sell it so having a survey makes good sense – and could save you thousands of pounds and will give you peace of mind.

When buying a home Which? The Council of Mortgage Lenders and the Building Societies Association advise you to get a survey before you buy, and not just to rely on a valuation. A valuation is not a survey.

In Scotland, you are required by law to have a Home Report carried out on your property prior to marketing. The Home Report is a prescribed document which comprises of a single survey (with valuation), an EPC and a property questionnaire.

Using the services of an RICS regulated firm offers confidence because:

- they give you clear, impartial and expert advice

- they act in your interest

- they are tightly regulated and have to follow strict rules of conduct – including having in place insurance to protect you

- RICS members have to update their skills and knowledge throughout their careers, so you can rely on their expertise

- you are protected by a complaints procedure and access to independent redress, for example through an Ombudsman scheme.

Look out for firms that are ‘Regulated by RICS’. Estate agents and surveying firms that are regulated by RICS are easy to spot as they use ‘Regulated by RICS’ on their stationery and promotional material.

What you can expect from a survey?

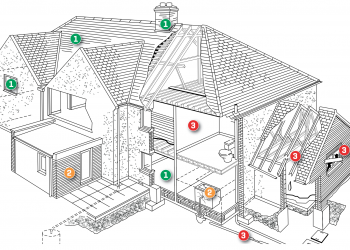

Surveys are a kind of ‘health check’ for buildings.

If you’re buying a home you should have a survey done before you enter into a contract. In Scotland, you will have access to a Home Report which includes a single survey, valuation, EPC and property questionnaire. The Home Report is commissioned by the seller but can be relied upon by the purchaser.

A survey can actually save you money. If there are problems, you can often re-negotiate the sale price of the home to reflect the cost of necessary repairs – or you may even decide you don’t want to buy it at all.

If you’re selling a home a survey can help you secure the agreed price and protect the sale. In Scotland, the law requires you to obtain a Home Report.

Your surveyor will report on all the parts of the home that can be easily reached and seen in accordance with terms of engagement agreed with you beforehand.

There are three levels of surveys undertaken by RICS members:

- Level 1 — RICS Condition Report

- Level 2 — RICS HomeBuyer Report

- Level 3 — RICS Building Survey.

There are also other surveys available from RICS members too.

Talk them through with an RICS member – they’ll be happy to discuss your particular concerns in more detail and help you decide which type of survey is right for you.

If you’re interested in making structural changes to a home or you think there may be a damp or dry rot problem, an RICS member will be able to advise you about this too.

Their report is designed to help you make a more informed decision. Costs vary according to which type of survey you have, but all can offer reassurance.

Lender’s valuation and Energy Performance Certificate

A lender’s valuation is usually required when you are buying a home. It isn’t a survey. It’s a limited check on the home that your mortgage lender carries out to ensure it’s worth the money they’re lending you.

They’ll probably ask you to pay for the valuation. Lenders may provide a copy of the mortgage valuation to the buyer but it is unlikely to cover items of detail which would be picked up in a survey.

There may be problems in the property that would cost a huge amount to put right – and they won’t appear in the valuation report. This is why it’s really important you have a survey. An RICS surveyor is fully qualified to carry out a survey before you buy your home.

An Energy Performance Certificate (EPC) is not a survey but you may come across it as it has to be provided by law by a seller (or agent) when a home is marketed for sale. It is commissioned from an accredited Domestic Energy Assessor (DEA), who visits the property to collect the relevant data and creates the certificate. The DEA may be a member of RICS. For further information visit www.rics.org/epc

In Scotland, the EPC forms part of the Home Report and will be undertaken by the surveyor when the single survey and valuation are carried out.

RICS Home surveys

There are effectively three different types of survey to choose from as defined by RICS Home Surveys. For further information visit www.rics.org/homesurveys. These can only be carried out by qualified surveyors licensed to do so. Reliable and cost-effective, these reports carry the full weight of RICS – the industry’s most respected authority on surveying. Some chartered surveyors offer their own-format home survey services. Whilst you are free to choose you are advised to see how others compare to the standard RICS Home Surveys services as described on pages 8 to 11. For instance, some own-format reports may not include ‘traffic-light ratings as part of the service.

Buying a home

It’s important to remember that your mortgage lender’s valuation report is not a survey. It merely tells your lender whether or not the property is reasonable security for your loan.

A home survey will tell you the actual condition of the property. That’s vital information that can be invaluable during price negotiations, and will also help you avoid expensive surprises after you’ve moved in.

Selling a home

A home survey can help you prepare for selling your property. It will show you any problems that may delay your sale or cause price reductions later in the process.

Staying at home

A home survey of the current condition of your home will warn you of defects and help you avoid escalating repair and maintenance costs in the future. It will also be extremely useful if you’re thinking of remortgaging. RICS members offer other survey services to eg. specific defect reports.

RICS Condition Report (Survey level one)

Choose this report if you’re buying, selling or living in a conventional house, flat or bungalow built from common building materials and in good condition. It focuses purely on the condition of the property by setting out the following:

- clear ‘traffic light’ ratings of the condition of different parts of the building, services, garage and outbuildings, showing problems that require varying degrees of attention

- a summary of the risks to the condition of the building; and other matters including guarantees, planning and building control issues for your legal advisers.

- An RICS Condition Report does not include a valuation, but your surveyor may be able to provide this as a separate extra service.

- Ask your surveyor for a detailed Description of the RICS Condition Report Service leaflet or visit www.rics.org/homesurveys

RICS HomeBuyer Report (Survey level two)

Choose this report if you would like more extensive information whilst buying or selling a conventional house, flat or bungalow, built from common building materials and in reasonable condition. It costs more than the Condition Report but includes:

- all of the features in the Condition Report plus a more extensive inspection

- the surveyor’s professional opinion on the ‘Market Value’ of the property

- an insurance reinstatement figure for the property

- a list of problems that the surveyor considers may affect the value of the property

- advice on repairs and ongoing maintenance

- issues that need to be investigated to prevent serious damage or dangerous conditions

- legal issues that need to be addressed before completing your conveyancing and

- information on location, local environment and the recorded energy efficiency (where available).

Ask your surveyor for a detailed Description of the RICS HomeBuyer service leaflet or visit www.rics.org/homesurveys

Home Report (Scotland)

The Home Report is a pack which contains information about a property which is on the market for sale in Scotland. The Home Report is required by law for homes in Scotland marketed for sale from 1 December 2008.

The Home report has 3 parts:

- Single Survey and Valuation: This gives information on the condition of the property and how urgently it needs to be prepared. It also states the current market value and accessibility for disabled access.

- An Energy Report and EPC.

- A Property Questionnaire: Contains information on the council tax banding, parking arrangements, electricity supplier as well as other general information.

RICS Building Survey (Survey level three)

You should choose an RICS Building Survey if you’re dealing with a large, older or run-down property, a building that is unusual or altered, or if you’re planning major works. It costs more than the other RICS reports because it gives detailed information about the structure and fabric of the property.

It includes:

- a thorough inspection and detailed report on a wider range of issues

- a description of visible defects and potential problems caused by hidden flaws

- an outline of repair options and the likely consequences of inactivity and

- advice for your legal advisers and details of serious risks and dangerous conditions.

An RICS Building Survey does not include a valuation, but your surveyor may be able to provide this as a separate extra service. Estimated costs of repairs may also be included as an option.

For further information ask your surveyor or visit www.rics.org/homesurveys

Easy reference chart

This table will help you choose the most appropriate survey, but if you have any particular requirements, remember to discuss them with your surveyor before the inspection of the property. The surveyor may be able to provide you with extra services, under separate contracts.

Useful links

Here are some useful contact numbers and website addresses:

RICS – www.rics.org

Which? – www.which.net

Homecheck – www.homecheck.co.uk

HM Revenue & Customs – www.hmrc.gov.uk

Land Registry – www.landregistry.gov.uk

Land Registers of Northern Ireland – www.lrni.gov.uk

General Consumer Council Northern Ireland – www.gccni.org.uk

Council of Mortgage Lenders – www.cml.org.uk

Building Societies Association – www.bsa.org.uk

Law Society – www.lawsociety.org.uk

Scotland

Home reports/Single survey – www.rics.org/scotland www.scotland.gov.uk

Registers of Scotland – www.ros.gov.uk

Law Society of Scotland – www.lawscot.org.uk

Free RICS guides

RICS has a range of free guides available for the property issues listed here.

Development issues

Compulsory purchase

Home extensions

Home hazards

Dilapidations

Flooding

Japanese knotweed

Subsidence

Neighbour issues

Boundary disputes

Party walls

Right to light

Residential

Buying a home

Buying and selling art and antiques at auction

Home surveys

Letting a property

Property auctions

Renting a property

Selling a home

Further information

We hope this guide is useful to you. If you’d like to know more about home surveys, or how RICS can help, please contact us.

Visit our website rics.org/homesurveys alternatively email contactrics@rics.org or call the RICS Contact Centre 02476 868 555

Consumer helplines

RICS offers telephone helplines giving you 30 minutes of free advice on:

- Boundary disputes

- Party walls

- Compulsory purchase.

Just call 02476 868 555 and you will be put in touch with an RICS member local to you, willing to provide a free 30-minute initial consultation. Lines are open 0830 –1730 (GMT), Monday to Friday.

Find a Surveyor

Contact us if you want to find independent, impartial advice from a qualified professional with good local knowledge.

Look out for firms that are ‘Regulated by RICS’. Estate agents and surveying firms that are regulated by RICS are easy to spot as they use ‘Regulated by RICS’ on their stationery and promotional material.

To find an RICS firm in your area visit www.ricsfirms.com alternatively email contactrics@rics.org or call the RICS Contact Centre 02476 868 555